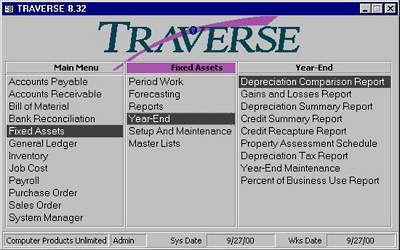

Fixed Assets

Make sound management

decisions, meet government reporting

requirements, save time.

You need to analyze the tax

and cash-flow implications of assets before you

acquire them. Once you have them, you need to

track their valuation and depreciation. Traverse

Fixed Assets gives you the power to do just

that. It will help you make wise decisions about

when to buy, when to lease, and how to manage

your capital for maximum return. You'll also

have the full range of financial and management

reports you need to manage your investments and

meet tax reporting requirements.

Traverse provides the

capability for Internet/Intranet access and

provides a seamless interface to Microsoft

Office products such as Word, Excel, and Mail.

You'll have the forecasting tools you need to

evaluate leases, amortize loans, and experiment

with depreciation strategies before you make a

capital commitment.

Keep an eye on your

depreciation options with four depreciation

books that let you track four sets of

depreciation information. You can also retire

assets at any time. Track the difference between

estimated depreciable and actual service life

and calculate the cost or proceeds from the

retirement of an asset.

You'll stay up to date with

tax law changes. Fixed Assets provides a set of

IRS-supplied depreciation tables and supports

MACRS, ACRS, straight line, sum-of-the-year

digits, and declining balance recovery methods.

Flexible tables help you make changes easily to

stay current with tax laws.

The Depreciation Comparison

report helps you compare any two depreciation

books - Tax Value, Book Value, Alternative

Minimum Tax or Other. |